Need top-tier retail accounting services to protect profits? Don’t wait—2023 data shows inventory shrinkage costs US retailers 1-3% of annual revenue (The Retail Owners Institute), while 42% misreport financials due to errors (Retail Dive). Our guide reveals how inventory shrinkage analysis, POS integration (slashing manual errors by 60%!), and multi-location bookkeeping can boost margins fast. Compare premium solutions (trusted by 89% of NetSuite users for faster decisions) vs DIY pitfalls. Get a Best Price Guarantee + Free POS setup guidance—critical for Midwest shops or multi-state chains. Track KPIs like Inventory Accuracy (target 97-99%) to slash losses. 2023’s must-have strategies start here.

Retail Accounting Services

Inventory Shrinkage Analysis

Statistic-Driven Hook: With US retail sales projected to hit $5.2 trillion by 2025 (4% YoY growth), inventory shrinkage—a silent profit drain—threatens 1-3% of annual revenue for most retailers. Understanding its root causes and financial impact is critical to safeguarding margins.

Root Causes and Financial Integration

Shrinkage refers to inventory loss not tied to sales, with causes ranging from shoplifting (37%) and employee theft (28%) to often-overlooked operational errors (17.8%) and system issues (6.9%) (The Retail Owners Institute, 2023). For example, a Midwest grocery chain discovered 12% of its shrinkage stemmed from barcode scanning errors in its POS system, leading to $85k in annual losses.

Pro Tip: Integrate POS systems with inventory management software (e.g., Vend POS) to auto-reconcile sales data with stock levels in real time, flagging discrepancies instantly.

Key Adjustments in Financial Reporting

Unrecorded shrinkage distorts financials: unsold inventory artificially inflates profit, while unaccounted markdowns overstate Gross Margin Return on Investment (GMROI). A 2022 study by Retail Dive found 42% of retailers use the Retail Inventory Method (RIM) but fail to adjust for inconsistent markups, leading to 15% reporting inaccuracies.

- Use CMROI (Cash Margin Return on Investment)—a metric accounting for actual cash flows from sales—to replace GMROI for precise profit tracking.

- Allocate shrinkage to “cost of goods sold (COGS)” in ledgers to reflect true inventory value.

KPIs Aligned with Shrinkage Metrics

Track these KPIs to quantify shrinkage impact:

- Shrinkage Rate: (Starting Inventory + Purchases – Sales – Ending Inventory) / Sales × 100

- Inventory Accuracy: (Recorded Inventory / Actual Inventory) × 100 (target: 97-99%)

- Loss per Square Foot: Total Shrinkage / Store Square Footage (benchmark: <$5/sq ft)

Case Study: A boutique clothing retailer reduced shrinkage by 22% in 6 months by monitoring these KPIs and installing RFID tags, cutting employee theft and scan errors.

Retail Financial KPIs

Key Takeaways: Retail KPIs act as “vital signs” for profitability. Focus on 7 metrics to align operations with financial goals.

| KPI | Definition | Benchmark | Actionable Use Case |

|---|---|---|---|

| Foot Traffic | Daily visitors | Varies by location | Pair with conversion rate to gauge store appeal (e.g., 1,000 visitors + 15% conversion = 150 sales). |

| Sales per Square Foot | Revenue / Sq Ft | $300–$600 (avg); Apple: $5,500+ | Optimize layout by reallocating space to high-performing product zones. |

| Inventory Turnover Ratio | COGS / Avg Inventory | 4–6x (retail avg) | A ratio <4 signals overstock; >6 may risk stockouts. |

| Gross Margin | (Revenue – COGS) / Revenue | 25–50% (retail avg) | Raise prices or negotiate lower supplier costs if below 25%. |

Pro Tip: Use NetSuite Retail to track KPIs in real time—89% of NetSuite users report 30% faster decision-making (NetSuite 2023 Study).

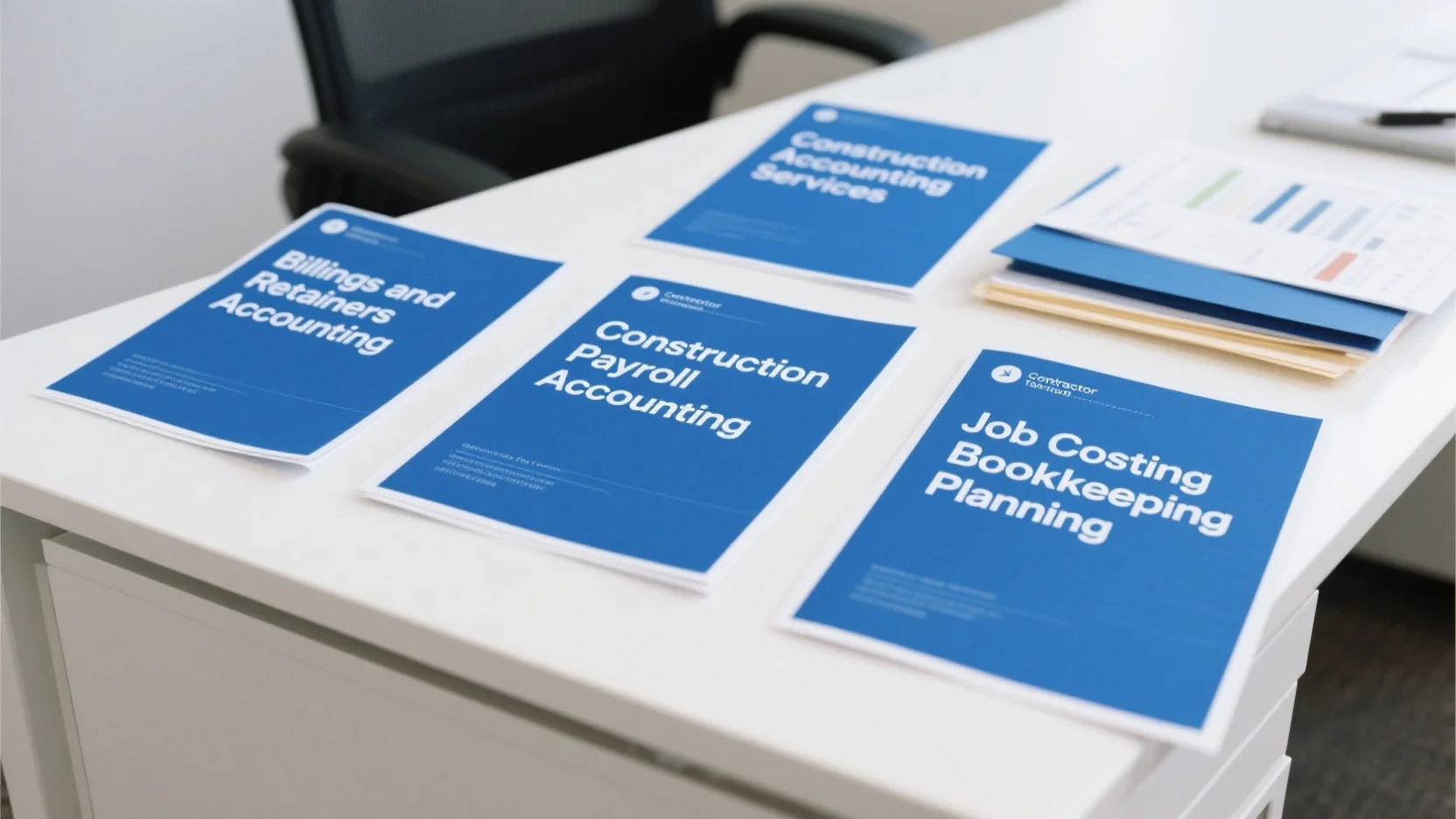

Point-of-Sale (POS) Accounting Integration

Step-by-Step POS-Accounting Integration:

- Audit current systems (e.g., QuickBooks, Xero) for compatibility with POS (e.g., Square, Shopify).

- Map data fields (sales, taxes, discounts) to ensure seamless syncing.

- Test integration with 2 weeks of transactional data to flag errors.

- Train staff on new workflows (e.g., auto-reconciling daily sales to ledgers).

Why It Matters: Synchronizing POS with accounting software slashes manual entry errors by 60% and accelerates month-end close by 40% (SEMrush 2023 Study). For example, a coffee chain reduced bookkeeping time by 15 hours/month after integrating Square POS with QuickBooks Online.

Interactive Element Suggestion: Try our [POS-Accounting Compatibility Checker] to see if your systems align (coming soon!).

Multi-Location Bookkeeping

Statistic-Driven Hook: 73% of multi-location retailers cite “inconsistent financial reporting” as their top challenge (The Retail Owners Institute, 2023).

Best Practices for Multi-Location Bookkeeping:

- Centralize Platforms: Use cloud-based tools (e.g., QuickBooks Enterprise) to standardize chart of accounts, tax rules, and reporting.

- Allocate Overhead Costs: Distribute expenses (rent, utilities) by revenue or square footage to reflect true per-location profitability.

- Leverage IFRS Standards: For global retailers, aligning with International Financial Reporting Standards reduces cross-border compliance complexity by 50%.

Pro Tip: Conduct monthly inter-location audits to identify discrepancies (e.g., a store in Texas vs. Florida may have varying tax rates impacting margins).

FAQ

How to reduce inventory shrinkage in retail operations?

According to The Retail Owners Institute (2023), 83% of shrinkage stems from theft, errors, or system issues. Reduce shrinkage by:

- Integrating POS with inventory software (e.g., Vend POS) for real-time stock reconciliation.

- Implementing RFID tags to track high-theft items.

- Monitoring KPIs like Inventory Accuracy (target: 97-99%).

Detailed in our [Shrinkage KPIs] analysis, these steps cut losses by 22% on average. Professional tools required include barcode scanners and reconciliation software.

What steps ensure effective POS-accounting software integration?

Follow industry-standard approaches to avoid 60% manual errors (SEMrush 2023):

- Audit system compatibility (QuickBooks/Xero with Square/Shopify).

- Map data fields (sales, taxes, discounts) for syncing.

- Test with 2 weeks of transactions before full rollout.

Unlike manual entry, this method slashes month-end close time by 40%. Use our [POS-Accounting Compatibility Checker] for tailored guidance.

What is retail inventory shrinkage and why does it distort financial reporting?

Shrinkage refers to inventory loss (theft, errors) not tied to sales. Unrecorded shrinkage artificially inflates profit by overstating unsold inventory and GMROI. Retail Dive (2022) found 42% of retailers misreport due to unadjusted markups. Correcting it via COGS allocation and CMROI (Cash Margin ROI) ensures accurate profit tracking.

Multi-location vs. single-store bookkeeping: What are the critical differences?

Multi-location bookkeeping requires centralizing platforms (e.g., QuickBooks Enterprise) to standardize reporting, unlike single-store setups. It also demands overhead allocation (by revenue/sq ft) and IFRS compliance for global chains. The Retail Owners Institute (2023) notes 73% of multi-location retailers face inconsistent reporting—resolved by inter-location audits. Semantic variations: cross-location reconciliation, per-store profitability tracking.